The State of Financial Crime 2023

From economic volatility to the war in Ukraine, 2023 will be a complex year for compliance professionals. Our report combines a state-of-the-industry survey with the latest subject matter expertise to offer a roadmap for the year ahead.

Download the report

Of firms say they’re re-evaluating their risk appetite due to the uncertain economic environment

Four top financial crime trends for 2023

- Financial crime is set to soar as economies falter. 59 percent of firms expect crime levels to rise, with 58 percent planning to hire more staff. A faltering economy could increase levels of risk-taking behavior.

- Fraud and scams continue to evolve. Tax and investment fraud are top concerns for compliance teams, with the temptation for criminals to offer bogus “get rich quick” schemes rising as the economy worsens.

- Environmental crime surges. Environmental crime was the second highest typology of concern for firms when submitting suspicious activity reports (SARs).

- Crowdfunding fuels political extremism. 87 percent of compliance teams told us they’d seen an increase in the use of crowdfunding platforms to support political extremism over the last 12 months.

Our report analyzes of the topics compliance teams will encounter in 2023 and how they can prepare effectively.

“ 2023 was supposed to be the year we escaped the shockwaves of the COVID-19 pandemic. It’s clear from this year’s survey that won’t be the case. We highlight areas - including financing terrorist groups through decentralized platforms and environmental crime - where trends have accelerated through the pandemic. ”

Andrew Davies | Global Head of Regulatory Affairs at ComplyAdvantage

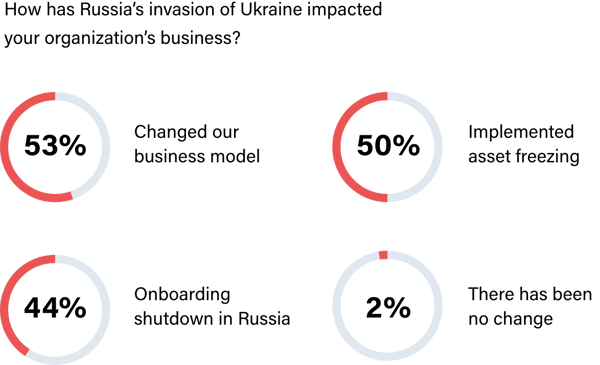

How will the war in Ukraine impact global sanctions in 2023?

Unsurprisingly, Russia is the geopolitical hotspot firms worldwide are most concerned about. We expect a stalemate well into 2023. As a result, compliance teams should expect new sectoral sanctions from Western powers and a greater emphasis on the enforcement. While the overall number of designations will rise, sanctions may be scaled back in some areas. We explore the road ahead and other potential sanctions inflection points.

Of firms say their knowledge of regulations would be 'at risk' in an audit of the compliance function

Prepare for new anti-money laundering regulations

In the United States, the Biden administration will continue tackling illicit financial flows and building a crypto regulatory framework. Meanwhile, the European Union is preparing to roll out its most comprehensive anti-money laundering regulatory package ever. In Asia Pacific, Hong Kong is implementing a virtual asset licensing regime, Australia faces pressure to regulate non-financial professions, including lawyers and real estate agents, and Singapore plans a new Corporate Service Providers Bill. Our report assesses the landscape in 2023 to help firms anticipate potential reforms.

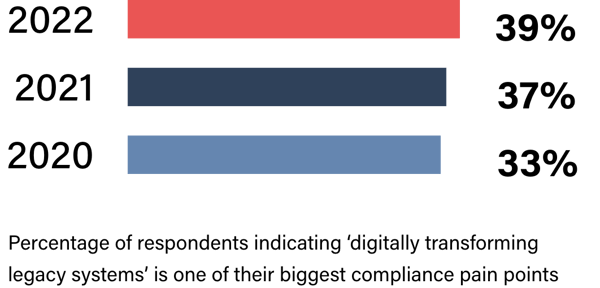

Firms are rethinking their approach to regulatory technology

How can firms effectively manage customer data, meet increasing regulatory expectations, and combat competitive pressures? There is a growing recognition of the need to 'get the fundamentals right.' For the compliance function, this means how their data and teams are structured. 39 percent of firms said digitally transforming legacy systems was their most significant compliance-related pain point, six percentage points higher than two years ago. From data transformation to AI and ESG, we explore the wider trends shaping the compliance function today.

Request a Demo →

Request a Demo →

The Compliance Team’s Guide to Customer Onboarding - Part 1

The Compliance Team’s Guide to Customer Onboarding - Part 1

The State of Financial Crime 2023

The State of Financial Crime 2023

ComplyAdvantage Takes on Payment Fraud with New AI-powered Solution

ComplyAdvantage Takes on Payment Fraud with New AI-powered Solution