Get in touch to speak to us

Transaction Screening

Our 2-way API allows quick payment processing by stopping suspicious payments

reaching its destination sending immediate alerts to your compliance team until they remediate the alert.

World Leading AML DataGlobal coverage of Sanctions & Watchlists, updated as quickly as every 15 minutes to better facilitate the ability to stop illicit payments immediately. |

Faster payment processingScreen transactions in real-time and without disruption to your payment flow thanks to our highly functional, RESTful API with Webhooks. |

Fewer false positivesMinimize your operational workload and overhead costs by tailoring our comprehensive matching technology and data sets to your risk-appetite. |

Straight-through ProcessingOur platform enables compliance teams to block high-risk transactions before they are processed, whilst allowing safe payments to pass through your ecosystem automatically without delay. |

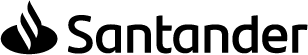

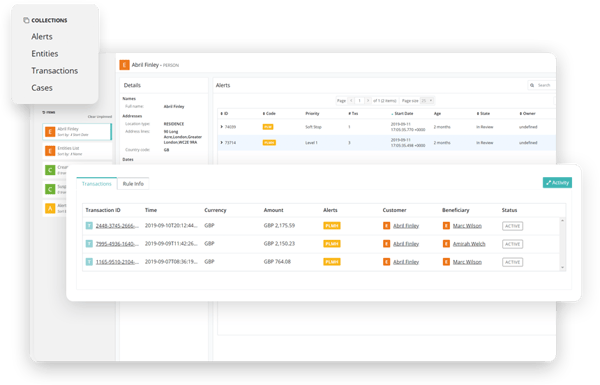

Transaction Monitoring

-

Keep up with changing risks quickly by easily tailoring scenarios.

-

Implement quickly, easily and securely with REST API or Batch File Uploads.

-

Prevent suspicious activity in real-time or retrospectively using our REST API.

-

Increase automation and minimize unnecessary alerts to transaction risks

-

Use current rules or set your own to meet regulatory requirements such as payment limits

We help organizations across the payments sector:

-

Mobile Money

-

Pre-Paid Cards

-

Remittance & FX Brokers

-

Virtual Currencies & Exchanges

-

Non-Bank Credit Card Issuers

-

Payment processors, Aggregators, Acquirers & Gateways

-

Virtual Currencies & Bitcoin

-

eWallets, eMoney, SPI, API, PSP, PISP, ASPSP, & AISP

-

Challenger / Neo Banks

Features

-

Real-Time Monitoring Capabilities

-

Configurable Rules Engine

-

Flexible API Integrations

Request a Demo →

Request a Demo →

The Compliance Team’s Guide to Customer Onboarding - Part 1

The Compliance Team’s Guide to Customer Onboarding - Part 1

The State of Financial Crime 2023

The State of Financial Crime 2023

ComplyAdvantage Takes on Payment Fraud with New AI-powered Solution

ComplyAdvantage Takes on Payment Fraud with New AI-powered Solution